december child tax credit payment dates

Understand how the 2021 Child Tax Credit works. US citizens enrolled in the Child Tax Credit scheme yet want to opt out of the December payment have until November 29 to update.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays.

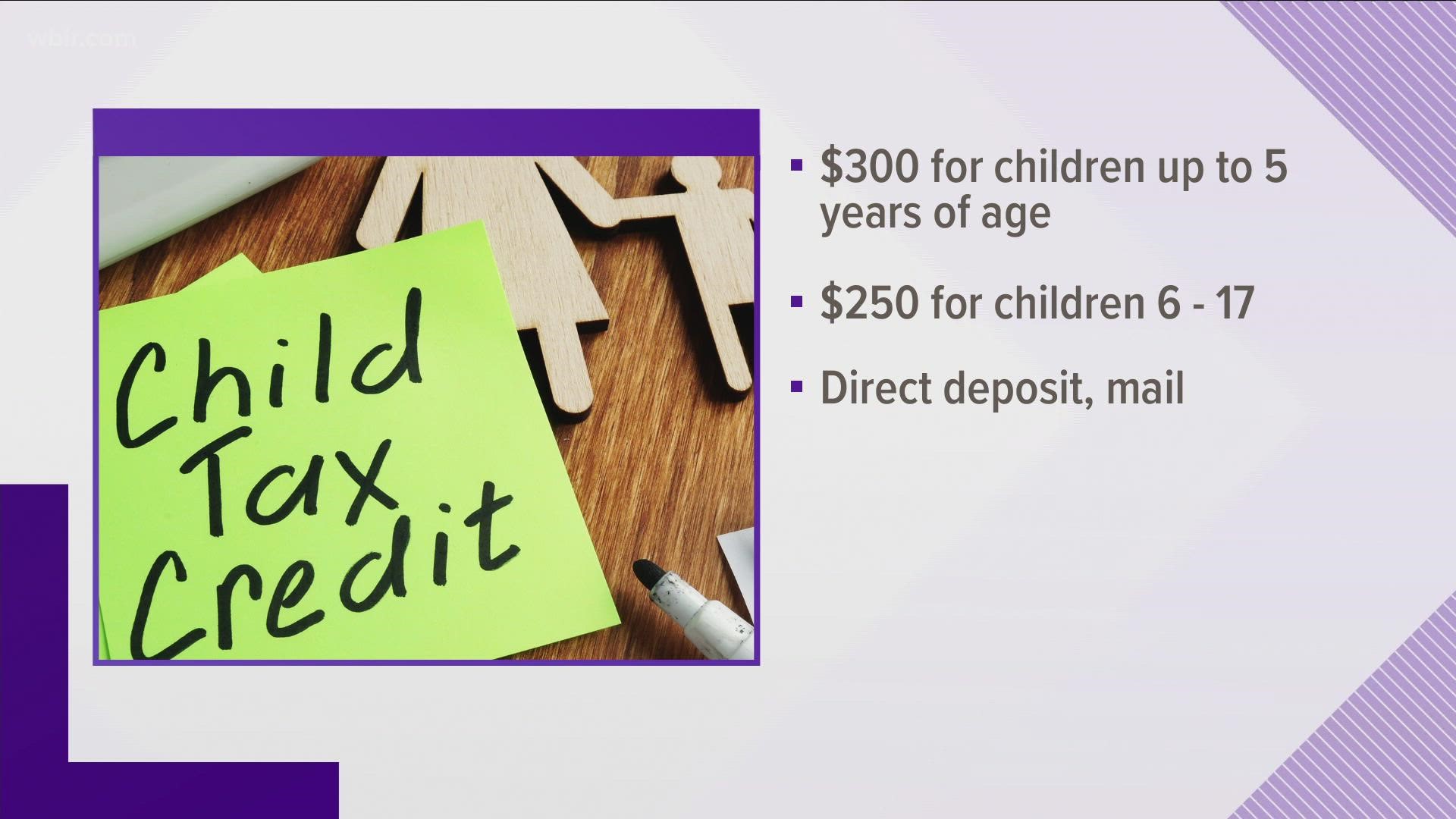

. Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. Ad Skip The Tax Store And Get Live Online Tax Help From A TurboTax Live Expert. Dont Miss an Extra 1800 per Kid.

Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their final advance Child Tax Credit CTC payment for the month of December. Users will need a.

15 opt out by Nov. The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December. Most parents who received monthly payments in 2021 will have more child tax credit money coming this year.

The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments. The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. Meet With A Live Tax Expert From The Comfort Of Your Home.

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. Wait 5 working days from the payment date to contact us. 15 opt out by Aug.

The next and last payment goes out on. You will not receive a monthly payment if your total benefit amount for the year is less than 240. File W 100 Confidence Online.

The IRS and US. The sixth and final payment goes out on December. Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News Before 2021 the Child Tax Credit maxed out at 2000 per child.

The other half of the credit can be claimed as a lump sum on taxes in April 2022. Dates for earlier payments are shown in the schedule below. The federal Child Tax Credit is kicking off.

15 opt out by Oct. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Department of the Treasury are ending out the final monthly child tax credit payment of the year to millions of American families Dec.

15 opt out by Nov. December 13 2022 Havent received your payment. Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of.

To reconcile advance payments on your 2021 return. Enter your information on Schedule 8812 Form 1040. December is not an exception to this but the date youll receive the payment may not be the same day.

See also Child Tax Credit 2022 Update. When to expect December child tax credit. The child tax credit payments are direct deposited into qualifying parents bank accounts on the 15th of every month.

When does the Child Tax Credit arrive in December. IR-2021-249 December 15 2021. 29 What happens with the child tax credit payments after December.

Goods and services tax harmonized sales. Instead you will receive one lump sum payment with your July payment. 7 rows Payment dates for the child tax credit payment.

The payment dates for the two main social assistance programs in alberta aish and income support are shown below. 28 December - England and Scotland only. All payment dates.

IRS Child Tax Credit Money. January 2022 Child Tax Credit Date. The child tax credit has grown to up to 3600 for the 2021 tax year.

Get your advance payments total and number of qualifying children in your online account. That includes up to 1800 per child under 6 or 1500 per child age 6 to 17 or up to 3600 per child under 6 or 3000. Child Tax Credit 2022 December.

13 opt out by Aug. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Child tax credit enhancement.

After the December 15 payment eligible parents can also expect to see a big payday in 2022 when the other half of the child tax credit is issued to American parents during tax.

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit United States Wikipedia

What To Know About The Child Tax Credit The New York Times

Child Tax Credit United States Wikipedia

Parents Guide To The Child Tax Credit Nextadvisor With Time

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

The Child Tax Credit Toolkit The White House

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities